Today, well over a year after the first lockdown measures were put in place, there are still lingering questions about whether remote work would now become a commonplace option, or whether things would generally return to the status quo in offices around the world. New data from LinkedIn’s Workforce Report shows that remote work may be here to stay, and could even become the norm in a few key industries. Broadly speaking, 12% of all Canadian paid job postings on LinkedIn offered remote work in September 2021. Prior to the pandemic, that number sat at just 1.3%. While this data was specific to Canada, the country’s similarity to the U.S. means that these trends are likely being seen across the border as well.

Which Industries are Embracing Remote Work?

The nature of work can vary broadly by job type—for example, mining is tough to do from one’s living room sofa—so remote jobs were not distributed equally across industries. Here are the numbers on job postings that were geared towards remote work: Tech and healthcare industries are showing big shifts towards remote work, with the latter being influenced by a number of tech-driven changes, including telemedicine. Physical distancing measures forced some industries to pivot quickly. Whether virtual fitness and wellness options (e.g. Peloton and Headspace) would remain popular beyond the pandemic was a big question mark, but this jobs data seems to indicate continued digital growth in these industries.

What the Future Holds

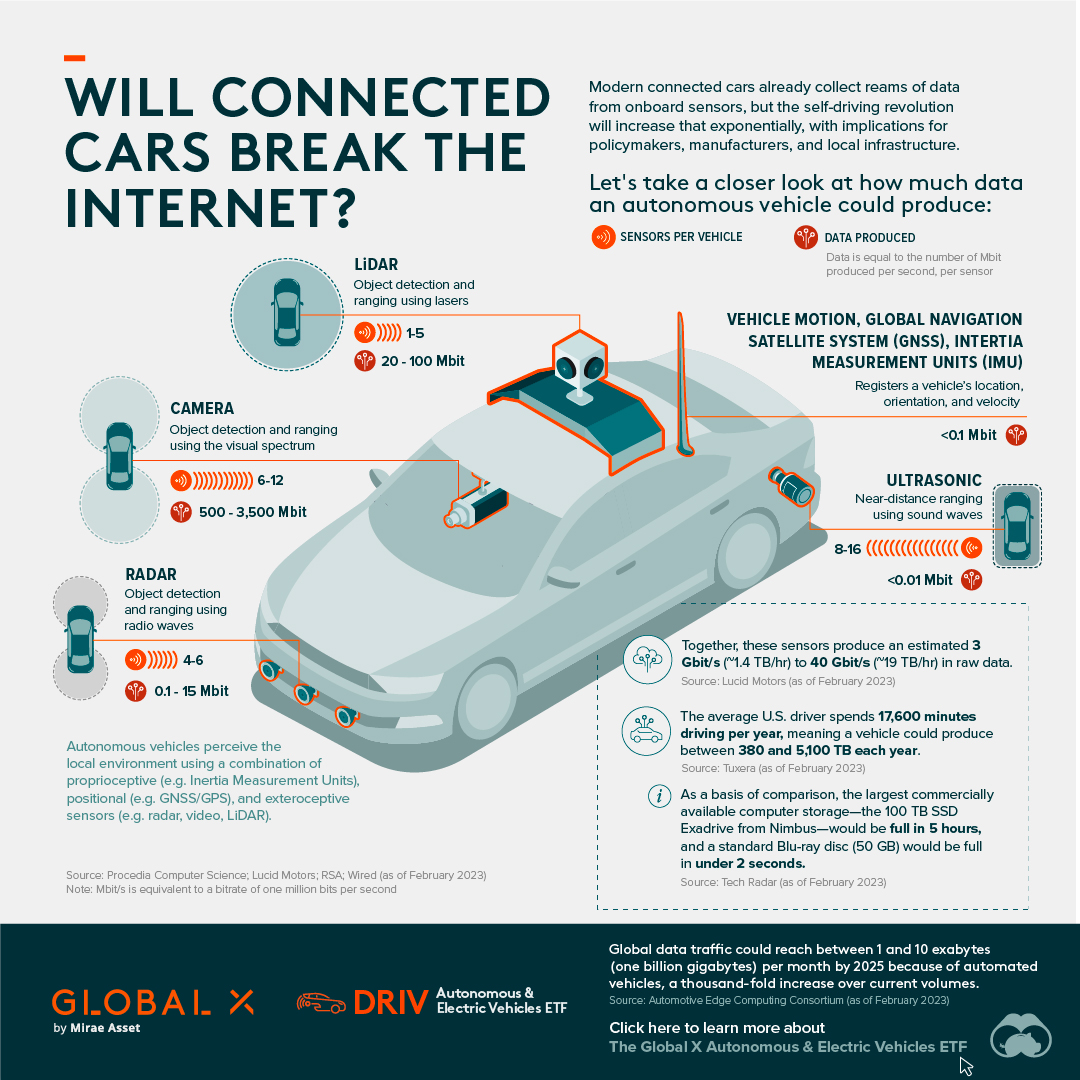

Since COVID-19 outbreaks are still underway, the true test for this trend will be whether these numbers hold up a year or two from now. When offices and gyms are reliably open again, will companies dial back the work-from-home options? Today, hybrid solutions are proving popular amidst worries that fully distributed teams suffer from lower levels of collaboration and communication between colleagues, and that innovation could be stifled by lack of in-person collaboration. Of course, employees themselves are reporting being more productive and happy at home, with 98% of people wanting the option to work remotely for the rest of their careers. It’s clear that the culture of work is undergoing an evolution today, and companies and employees will continue to seek the perfect balance of productivity and happiness. Source: LinkedIn’s Workforce Report for September 2021 (Canada) Data Note: LinkedIn analyzed hundreds of thousands of paid remote job postings in Canada posted on LinkedIn between February 2020 and September 21, 2021. A “remote job” is defined as one where either the job poster explicitly labeled it as “remote” or if the job contained keywords like “work from home” in the listing. on Today’s connected cars come stocked with as many as 200 onboard sensors, tracking everything from engine temperature to seatbelt status. And all those sensors create reams of data, which will increase exponentially as the autonomous driving revolution gathers pace. With carmakers planning on uploading 50-70% of that data, this has serious implications for policymakers, manufacturers, and local network infrastructure. In this visualization from our sponsor Global X ETFs, we ask the question: will connected cars break the internet?

Data is a Plural Noun

Just how much data could it possibly be? There are lots of estimates out there, from as much as 450 TB per day for robotaxis, to as little as 0.383 TB per hour for a minimally connected car. This visualization adds up the outputs from sensors found in a typical connected car of the future, with at least some self-driving capabilities. The focus is on the kinds of sensors that an automated vehicle might use, because these are the data hogs. Sensors like the one that turns on your check-oil-light probably doesn’t produce that much data. But a 4K camera at 30 frames a second, on the other hand, produces 5.4 TB per hour. All together, you could have somewhere between 1.4 TB and 19 TB per hour. Given that U.S. drivers spend 17,600 minutes driving per year, a vehicle could produce between 380 and 5,100 TB every year. To put that upper range into perspective, the largest commercially available computer storage—the 100 TB SSD Exadrive from Nimbus—would be full in 5 hours. A standard Blu-ray disc (50 GB) would be full in under 2 seconds.

Lag is a Drag

The problem is twofold. In the first place, the internet is better at downloading than uploading. And this makes sense when you think about it. How often are you uploading a video, versus downloading or streaming one? Average global mobile download speeds were 30.78 MB/s in July 2022, against 8.55 MB/s for uploads. Fixed broadband is much higher of course, but no one is suggesting that you connect really, really long network cables to moving vehicles.

Ultimately, there isn’t enough bandwidth to go around. Consider the types of data traffic that a connected car could produce:

Vehicle-to-vehicle (V2V) Vehicle-to-grid (V2G) Vehicles-to-people (V2P) Vehicles-to-infrastructure (V2I) Vehicles-to-everything (V2E)

The network just won’t be able to handle it.

Moreover, lag needs to be relatively non-existent for roads to be safe. If a traffic camera detects that another car has run a red light and is about to t-bone you, that message needs to get to you right now, not in a few seconds.

Full to the Gunwales

The second problem is storage. Just where is all this data supposed to go? In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025.

One study predicted that connected cars could be producing up to 10 exabytes per month, a thousand-fold increase over current data volumes.

At that rate, 8 ZB will be full in 2.2 years, which seems like a long time until you consider that we still need a place to put the rest of our data too.

At the Bleeding Edge

Fortunately, not all of that data needs to be uploaded. As already noted, automakers are only interested in uploading some of that. Also, privacy legislation in some jurisdictions may not allow highly personal data, like a car’s exact location, to be shared with manufacturers.

Uploading could also move to off-peak hours to even out demand on network infrastructure. Plug in your EV at the end of the day to charge, and upload data in the evening, when network traffic is down. This would be good for maintenance logs, but less useful for the kind of real-time data discussed above.

For that, Edge Computing could hold the answer. The Automotive Edge Computing Consortium has a plan for a next generation network based on distributed computing on localized networks. Storage and computing resources stay closer to the data source—the connected car—to improve response times and reduce bandwidth loads.

Invest in the Future of Road Transport

By 2030, 95% of new vehicles sold will be connected vehicles, up from 50% today, and companies are racing to meet the challenge, creating investing opportunities.

Learn more about the Global X Autonomous & Electric Vehicles ETF (DRIV). It provides exposure to companies involved in the development of autonomous vehicles, EVs, and EV components and materials.

And be sure to read about how experiential technologies like Edge Computing are driving change in road transport in Charting Disruption. This joint report by Global X ETFs and the Wall Street Journal is also available as a downloadable PDF.