However, modern economies are incredibly complex—and calamities like the 2008 financial crisis have already pushed traditional policy tools to their limits. In response, some central banks have turned to newer, more unconventional strategies such as quantitative easing and negative interest rates to do their work. In response to the COVID-19 pandemic, central banks are once again taking decisive action. To help us understand what’s being done, today’s infographic uses data from the International Monetary Fund (IMF) to compare the policy responses of 29 systemically important economies.

The Central Bank Toolkit

To begin, here are brief descriptions of each policy, which the IMF sorts into four categories:

1. Monetary Policies

Policies designed to control the money supply and promote stable economic growth.

2. External Policies

Policies designed to mitigate the effects of external economic shocks.

3. Financial Policies for Banks

Policies designed to support the banking system in times of distress.

4. Financial Policies for Borrowers

Policies designed to improve access to capital as well as provide relief for borrowers.

Putting Policies Into Practice

Let’s take a closer look at how these policy tools are being applied in the real world, particularly in the context of how central banks are battling the effects of the COVID-19 pandemic.

1. Monetary Policies

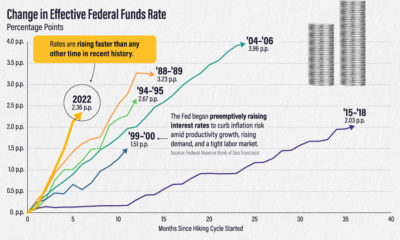

So far, many central banks have enacted expansionary monetary policies to boost slowing economies throughout the pandemic. One widely used tool has been policy rate cuts, or cuts to interest rates. The theory behind rate cuts is relatively straightforward—a central bank places downward pressure on short-term interest rates, decreasing the overall cost of borrowing. This ideally stimulates business investment and consumer spending. If short-term rates are already near zero, reducing them further may have little to no effect. For this reason, central banks have leaned on asset purchase schemes (quantitative easing) to place downward pressure on longer-term rates. This policy has been a cornerstone of the U.S. Federal Reserve’s (Fed) COVID-19 response, in which newly-created currency is used to buy hundreds of billions of dollars of assets such as government bonds. When the media says the Fed is “printing money”, this is what they’re actually referring to.

2. External Policies

External policies were less relied upon by the systemically important central banks covered in today’s graphic. That’s because foreign currency interventions, central bank operations designed to influence exchange rates, are typically used by developing economies only. This is likely due to the higher exchange rate volatility experienced by these types of economies. For example, as investors flee emerging markets, Brazil has seen its exchange rate (BRL/USD) tumble 30% this year.

In an attempt to prevent further depreciation, the Central Bank of Brazil has used its foreign currency reserves to increase the supply of USD in the open market. These measures include purchases of $8.8B in USD-denominated Brazilian government bonds.

3. Financial Policies for Banks

Central banks are often tasked with regulating the commercial banking industry, meaning they have the authority to ease restrictions during economic crises. One option is to ease the countercyclical capital buffer. During periods of economic growth (and increased lending), banks must accumulate reserves as a safety net for when the economy eventually contracts. Easing this restriction can allow them to increase their lending capacity. —Andrea Enria, Chair of the ECB Supervisory Board The European Central Bank (ECB) is a large proponent of these policies. In March, it also allowed its supervised banks to make use of their liquidity buffers—liquid assets held by a bank to protect against unexpected cash flow needs.

4. Financial Policies for Borrowers

Borrowers have also received significant support. In the U.S., government-sponsored mortgage companies Fannie Mae and Freddie Mac have announced several COVID-19 relief measures:

Deferred payments for 12 months Late fees waived Suspended foreclosures and evictions for 60 days

The U.S. Fed has also created a number of facilities to support the flow of credit, including:

Primary Market Corporate Credit Facility: Purchasing bonds directly from highly-rated corporations to help them sustain their operations. Main Street Lending: Purchasing new or expanded loans from small and mid-sized businesses. Businesses with up to 15,000 employees or up to $5B in annual revenue are eligible. Municipal Liquidity Facility: Purchasing short-term debt directly from state and municipal governments. Counties with at least 500,000 residents and cities with at least 250,000 residents are eligible.

Longer-term Implications

Central bank responses to COVID-19 have been wide-reaching, to say the least. Yet, some of these policies come at the cost of burgeoning debt-levels, and critics are alarmed. In Europe, the ECB has come under scrutiny for its asset purchases since 2015. A ruling from Germany’s highest court labeled the program illegal, claiming it disadvantages German taxpayers (Germany makes larger contributions to the ECB than other member states). This ruling is not concerned with pandemic-related asset purchases, but it does present implications for future use. The U.S. Fed, which runs a similar program, has seen its balance sheet swell to nearly $7 trillion since the outbreak. Implications include a growing reliance on the Fed to fund government programs, and the high difficulty associated with safely reducing these holdings. on In this infographic, we’ve visualized data from the Fed’s most recent consumer debt update.

Aggressive Borrowing

The first chart in this graphic shows the growth in outstanding car loans between Q2 2020 (start of the pandemic) to Q4 2022 (latest available). We can see that Americans under the age of 40 have grown their vehicle-related debt the most. It’s natural for Gen Z (ages 11-26) to have higher growth figures because many of them are buying their first car, but 31% is quite high relatively speaking. Part of this can be attributed to today’s inflationary environment, which has pushed used car prices to new highs. Supply chain issues have also resulted in over 30% of new cars being sold above MSRP. Because of these rising prices, the Fed reports that the average auto loan is now $24,000, up 41% from 2019’s value of $17,000.

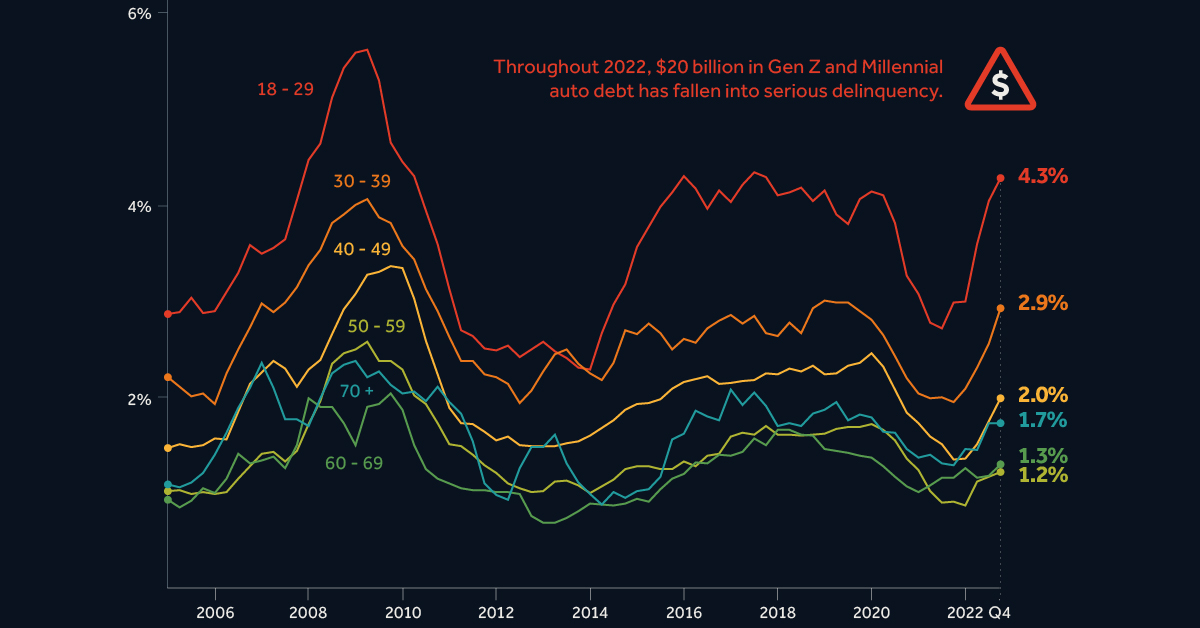

Spiking Delinquencies

Interest rates on auto loans are typically fixed, meaning many young Americans were able to take advantage of the low rates seen during the pandemic. Despite this, one in five Gen Zs say that their car payments account for over 20% of their after-tax income. Shown in the second chart of this infographic, the amount of auto debt transitioning into serious delinquency is much higher for Gen Z and Millennials. Throughout 2022, these generations saw $20 billion in auto debt fall 90+ days behind. The outlook for these struggling borrowers is bleak. First there’s inflation, which has pushed up the prices of most consumer goods. This eats into their ability to make car payments. Second is rising interest rates, which make credit card debt—another pain point for young borrowers—even more costly. Finally, there’s student loans, which are expected to resume in summer 2023. Payments on student debt have been suspended since the beginning of the COVID-19 pandemic.