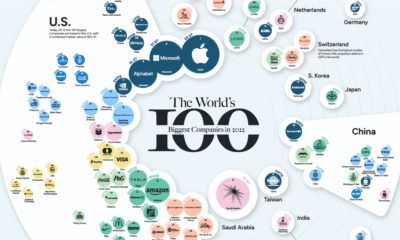

With an additional billion internet users projected to come online in the coming years, it’s possible that the social media universe could expand even further.

How the Networks Stack Up

To begin, let’s take a look at how social networks compare in terms of monthly active users (MAUs)—an industry metric widely used to gauge the success of these platforms. Here’s a closer look at individual social platforms, and their trials and tribulations:

To put it mildly, Facebook has had its hands full. A flurry of companies are boycotting Facebook’s ads, while the platform struggles to fend off the spread of misinformation. Yet, its stock price continues to advance to new highs while the traditional economy faces less than rosy forecasts. Facebook still possesses the largest cohort of users, inching closer to the 3 billion MAU mark—a breakthrough yet to be achieved by any company.

Snapchat

Snapchat and founder Evan Spiegel have had a bumpy road since their IPO in 2017. The stock price reached its nadir near $4 in 2018, reflecting investor concerns tied to the introduction of Instagram Stories. In recent times, the stock has advanced past the $20 mark, although there is still long-term unclarity around monetization and profitability.

YouTube

YouTube competes head on against traditional television and streaming programs for eyeballs. The platform raked in revenues of $15.1 billion in 2019, nearly double their figures in 2017. Parent company Alphabet has invested in YouTube with new rollouts like YouTube Music (merged with what was once Google Music) and YouTube Premium—a bundled subscription-based platform providing music, ad-free content, and YouTube Originals. By the looks of it, the future of YouTube will be much more than just videos.

The biggest social platform in China, WeChat has flourished, now holding a whopping 1.2 billion MAUs. As part of the Tencent Holdings conglomerate, they belong to the BATX group that is seen to lock horns with America’s Big Tech.

There have been whispers of a Reddit IPO on Wall Street for some time now. While such an event has not yet materialized, Reddit’s success certainly has. With 430 million MAUs relative to 330 million in 2018, the company continues to attract a larger audience. The notion of community has taken on a different meaning in the digital age, and Reddit represents this transition with their ever-growing network of users.

Instagram has been vital to Facebook’s success, since its $1 billion acquisition in 2012. The platform attracts a younger audience compared to Facebook and it has demonstrated an ability to remain versatile, specifically by implementing Instagram Stories and Reels.

Busy schedules don’t seem to faze Jack Dorsey who has not one, but two CEO jobs in Twitter and Square. Twitter has been able to achieve profitability in the last two years, reporting net income figures of $1.2 and $1.5 billion in 2018 and 2019 respectively. They no doubt have their work cut out for them as they continue to combat fake news and similar controversies on their platform.

TikTok

If any publicity is good publicity, then 2020 has been TikTok’s year. Headlines include privacy breaches with alleged ties to the Chinese Communist Party, a banning of the app by India Prime Minister Narendra Modi, and now, talks of a partial U.S. acquisition. Potential acquirers include leaders Microsoft, Twitter, and Oracle.

Social Media Under Trial?

Despite the list of headwinds social media has faced, about half of the world is now on it—and there seems to be no end in sight for future growth. How have companies with exposure to the social media universe fared in 2020 so far? Widespread participation in social media comes with its fair set of problems. Some companies such as Facebook have found themselves in the crosshairs on both sides of the political spectrum. As concerns grow around privacy and data, social media will be front and center in shaping the future of government, business, and politics. Only time will tell just how high user counts will reach. The long-term trajectory suggests there’s more room left in the engine. There are still parts of the world that are just beginning to possess the technological infrastructure for social media to be a possibility. It’s plausible future growth will come from that avenue. If stock prices of companies linked to social media are of relevance, their performance this year paired with the fact that they are trading near all-time highs supports such a growth thesis. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.