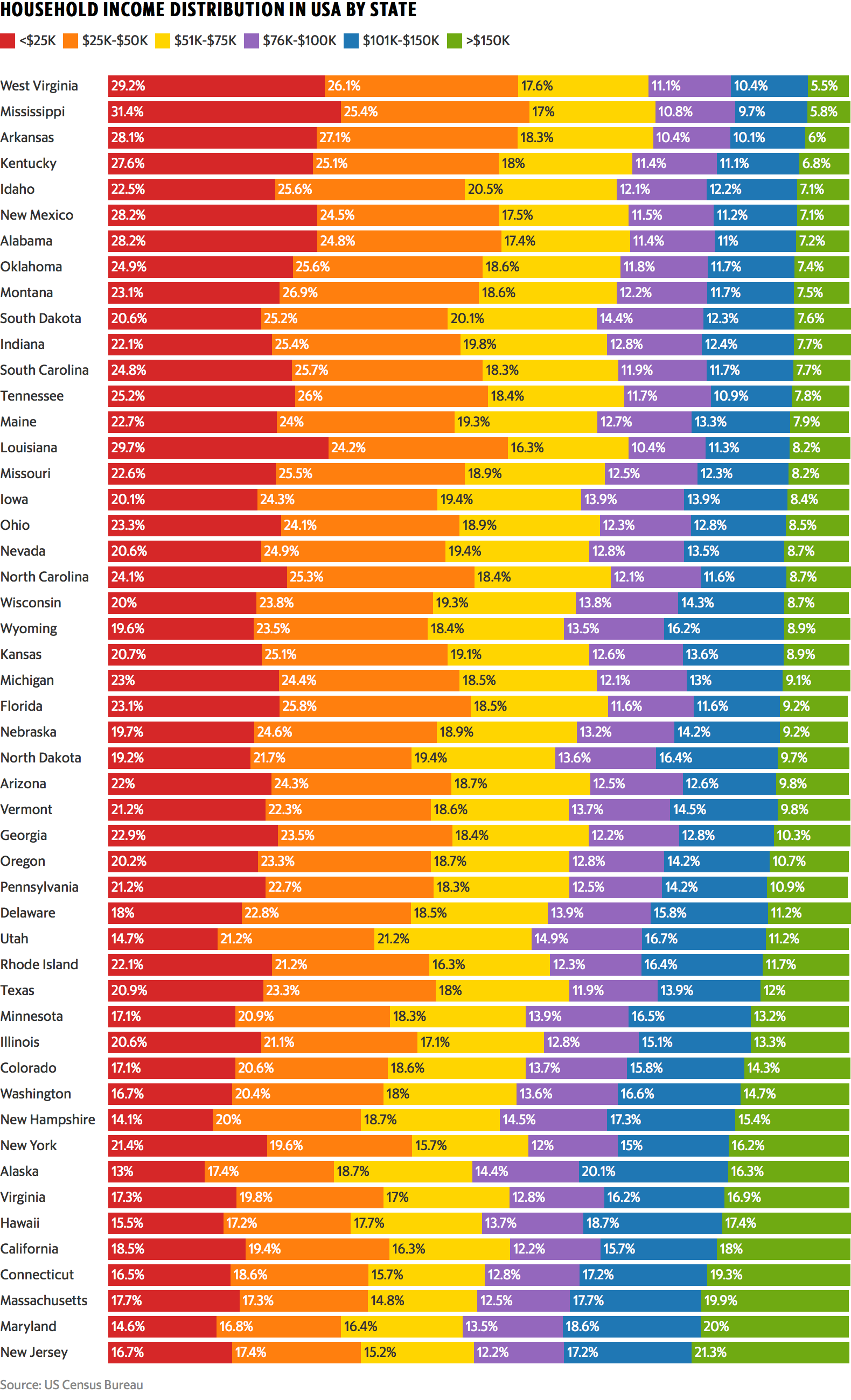

For example, in a state such as New York, there is a surplus of high-paying jobs available in tech and finance sectors. Meanwhile, in places like North Dakota and Alaska, there is an incredible endowment of natural resources that help create opportunity for the people living there.

Household Income by State

Today’s visualization from Reddit shows how different each state is based on annual household income distribution data. It’s worth noting that the below data does not take into account cost of living, which can have a big impact on how far that household income goes.

The above graphic, using data from the U.S. Census Bureau, shows the household income distribution for each state. The income for each state is broken down into six brackets (<$25k, $25k-$50k, etc), and data is sorted by the respective percentages of each state in the >$150k bracket.

Unlikely Leaders

Interestingly, the state with the highest percentage in the top bracket (>$150k) is New Jersey with 21.3% of households. The health and life sciences sectors are booming in the state – and 14 of 20 of the largest biopharmaceutical companies have operations in New Jersey. Meanwhile, important counties in the state also have proximity to big cities like New York City and Philadelphia, allowing people in the Garden State to easily commute to high-paying jobs in these metro centers. Another leader that some may consider to be a surprise? It’s the state of Alaska, which has the highest proportion of households (69.5%) earning >$50k per year in the entire country. The state is known for being rich in oil and gas, and part of the income for each household comes from the annual dividends of the Alaska Permanent Fund, which is worth $55 billion today.

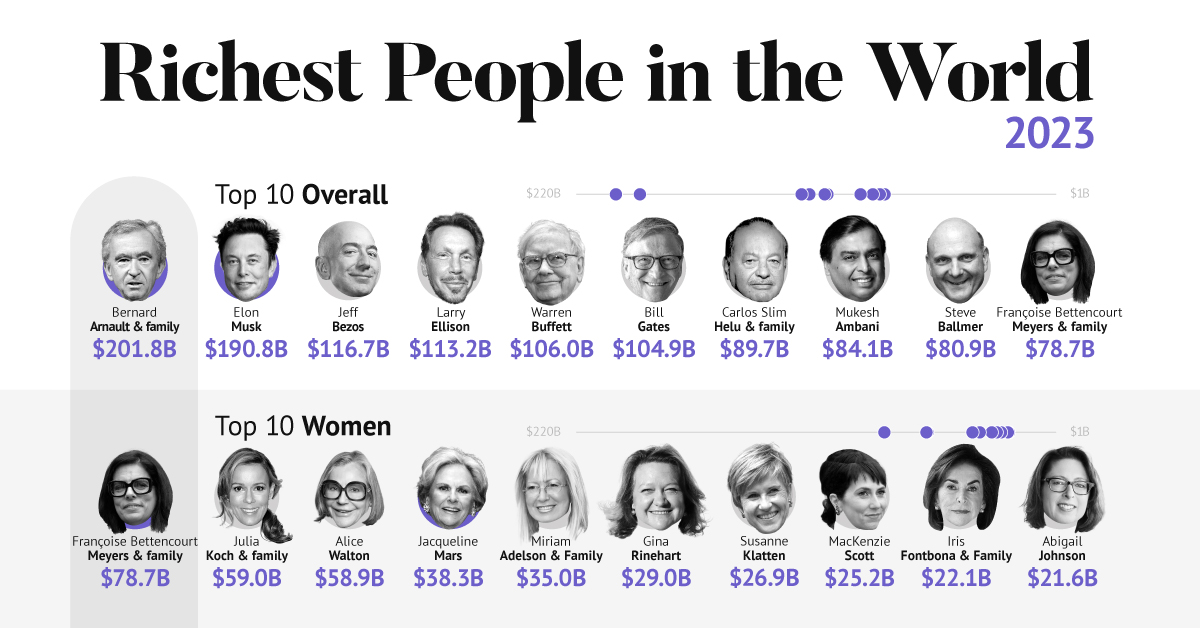

on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

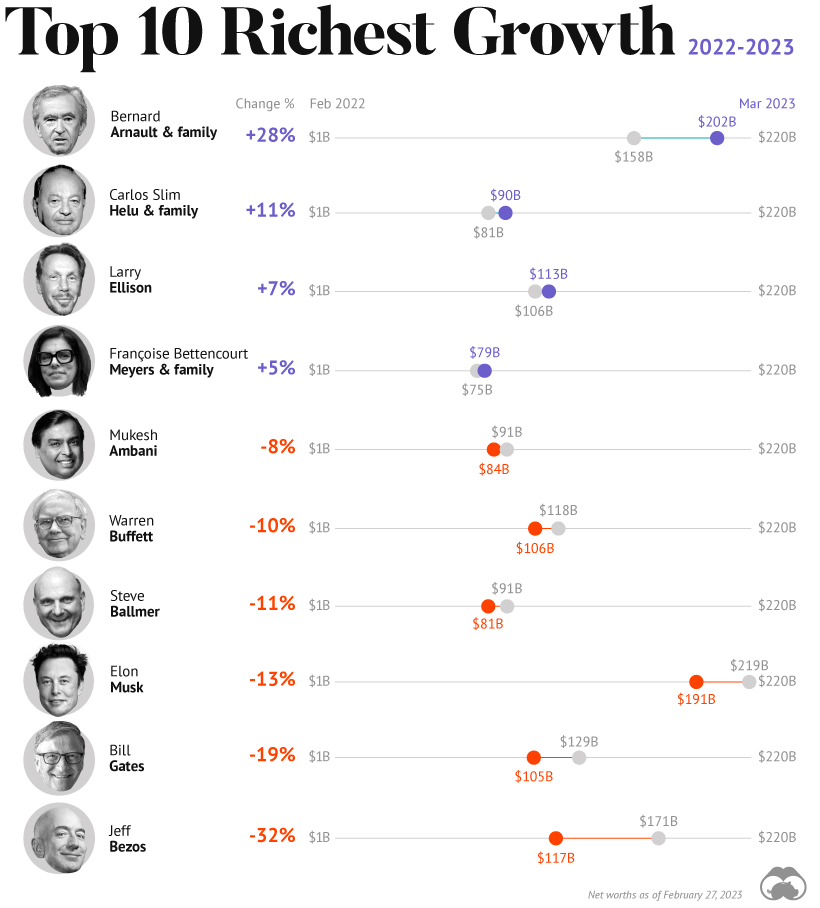

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.